the gift is not a ‘disqualified overseas gift’ (this applies only to payments made before 6 April 2010)ģ.2.2 A Gift Aid donation is treated as being made after the deduction of the basic rate of Income Tax in force at the time the donation is made, it’s that tax that the charity can reclaim provided the following conditions are met:.any benefits associated with the gift are within the statutory limits (read section ‘Donor benefits’).the gift is not part of an arrangement for the charity to acquire property from the individual or a connected person.the gift is not deductible from income for tax purposes.the gift is not a Payroll Giving donation.the gift is not subject to a condition as to repayment.The current legislation is at sections 413 to 430 Income Tax Act 2007.Ī donation qualifies for Gift Aid if it’s a gift consisting of a ‘payment of a sum of money’ by an individual who’s paid, or will pay UK tax, to a charity and satisfies all of the following conditions: companies (legislation at sections 191 to 202 Corporation Tax Act 2010)Ĭhapter 3.2 Gift Aid for individuals from 6 April 2000ģ.2.1 The Gift Aid Scheme was originally introduced by section 25 Finance Act 1990 but was substantially amended by Finance Act 2000 and later Finance Acts.individuals (legislation at sections 413 to 430 Income Tax Act 2007).This chapter covers the Gift Aid Schemes for donations to charity by: Chapter 3.45 Claiming Gift Aid on waived refunds and loan repayments.

Chapter 3.42 Claiming Gift Aid when goods are sold by, and the proceeds gifted to, charities.Chapter 3.41 Voluntary workers’ expenses.

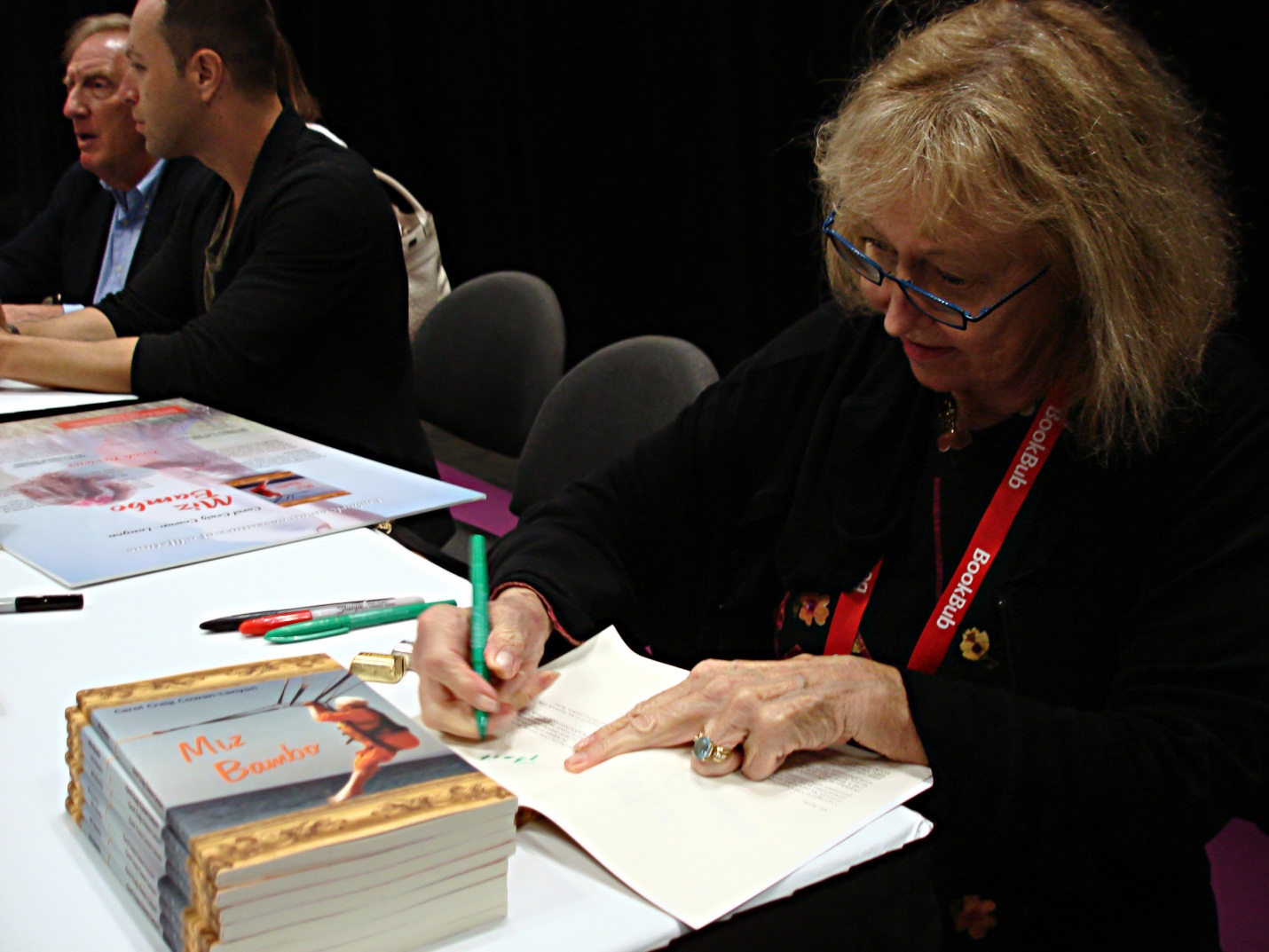

#Tradition of signing gifted book free#

Chapter 3.39 Gift Aid on donations that attract a right of free admission to charity property.Chapter 3.38 Adventure fundraising events - sponsorship payments and Gift Aid.Chapter 3.32 Donations from joint bank accounts.Chapter 3.31 Using envelopes to collect cash donations.Chapter 3.30 How long records should be kept.Chapter 3.26 Donations to support missionaries and other full-time workers for a charitable cause.Chapter 3.20 The limits on the value of benefits.Chapter 3.19 Things that are not a benefit.Chapter 3.18 Benefits received by donors and connected persons.Chapter 3.17 Inflated member-related expenditure by companies that are wholly owned by a CASC.Chapter 3.16 Companies only partly owned by a charity or CASC.Chapter 3.15 Estimated company donations.Chapter 3.14 Companies wholly owned by a charity or CASC.Chapter 3.13 Qualifying charitable donations and restrictions on Gift Aid treatment.Chapter 3.12 Tax treatment of companies making Gift Aid donations to charities or CASCs.Chapter 3.10 Particular types of Gift Aid declarations.Chapter 3.9 Further information on the contents of the Gift Aid declaration.Chapter 3.8 Declarations that have been invalidated or cancelled.Chapter 3.7 Recording and audit of Gift Aid declarations.Chapter 3.3 Individuals who can make a Gift Aid donation.Chapter 3.2 Gift Aid for individuals from 6 April 2000.

0 kommentar(er)

0 kommentar(er)